A start-up begins with a vision. For Georges Muller and David Bonzon, Co-Founders of SEED Biosciences, it was to help scientists isolate single cells reliably and cost-effectively. Five years after its birth in 2018, the company employs a team of 15 and has close to 50 clients and a range of investors on board. How did they make this happen? Georges Muller tells us more.

What approach to financing got you to where you are today?

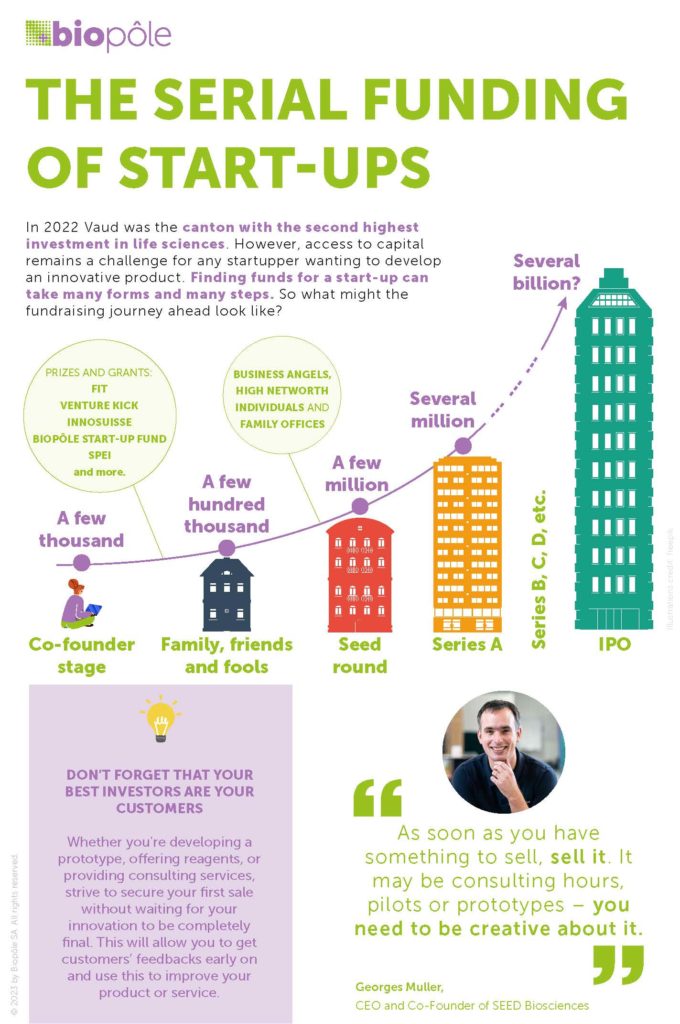

After starting SEED Biosciences, we wanted to get to market as soon as possible. And to develop a minimum viable product (also known as an MVP), it takes time and money. In the early stages, we received grants from innovation foundations Gebert Rüf Stiftung and Innosuisse. These non-dilutive funds – which means they don’t involve selling part of the company – helped us to develop an initial version of our product.

Beyond this first phase, we’ve sought funding from private individuals. SEED Biosciences is now financed by a range of business angels, who contribute different amounts.

Many start-ups are focused on raising capital, but you concentrated on sales from the very start. Can you tell us more?

The number-one aim for a start-up is to demonstrate success. And you do this by growing your company and its revenue. It figures, then, that the focus should be on sales.

The basic equation is as follows: focusing on sales and revenue will beget investment. This, in turn, will support the company’s growth. There’s no better reassurance for an investor than to see a company’s revenue is growing.

Before you can send your first invoice, you need to put something in the hands of your customers – and you should aim to do this as quickly as possible.

How quickly did you start to sell?

We sent our first invoice after a couple of weeks or so. Many start-ups wait until they have perfected the very best prototype or product before they sell anything. I believe it should be the other way around: as soon as you have something to sell, sell it. It may be consulting hours, pilots or prototypes – you need to be creative about it.

Betting on sales ensures steady growth, but how do you cope with capital-intensive competitors?

First of all, having competitors is always a good sign for a start-up. It means the market is attractive. We’re selling our first product and competing against different solutions in the field – both established companies and other start-ups.

We’re not too intimidated by capital-intensive competitors, as success isn’t just about the amount of funds you raise. Last year, we heard about a competitor in the United States that raised $30 million. A tremendous amount! But now, 18 months later, they’re still not on the market. So having liquidity pressure can sometimes be a good thing. It makes you focus on the sales and what’s important for your customers. This might mean taking smaller steps, but it doesn’t necessarily mean you’re slower. In our case, it meant getting to market earlier.