Founded in 2012, Distalmotion has grown massively from a four-person spin-off venture from the Robotics Lab of EPFL (the Swiss Federal Institute of Technology) to a team of 150, working from their own office at Biopôle overlooking Lake Geneva. Growth for life sciences companies can be slow, with a need to find early investment for costly R&D and complex regulations to navigate. We asked CEO and Board Member Michael Friedrich to tell us Distalmotion’s story and the secrets behind its remarkable progress.

The challenges

I joined Distalmotion in 2014, when it was two years old. Since then we’ve transitioned from an early-stage R&D venture into a fully functioning commercial operation, with CE-marked products on the market in Europe and the process for FDA approval in the US underway. However, please don’t let me give you the impression that this process was easy. Growth doesn’t happen overnight.

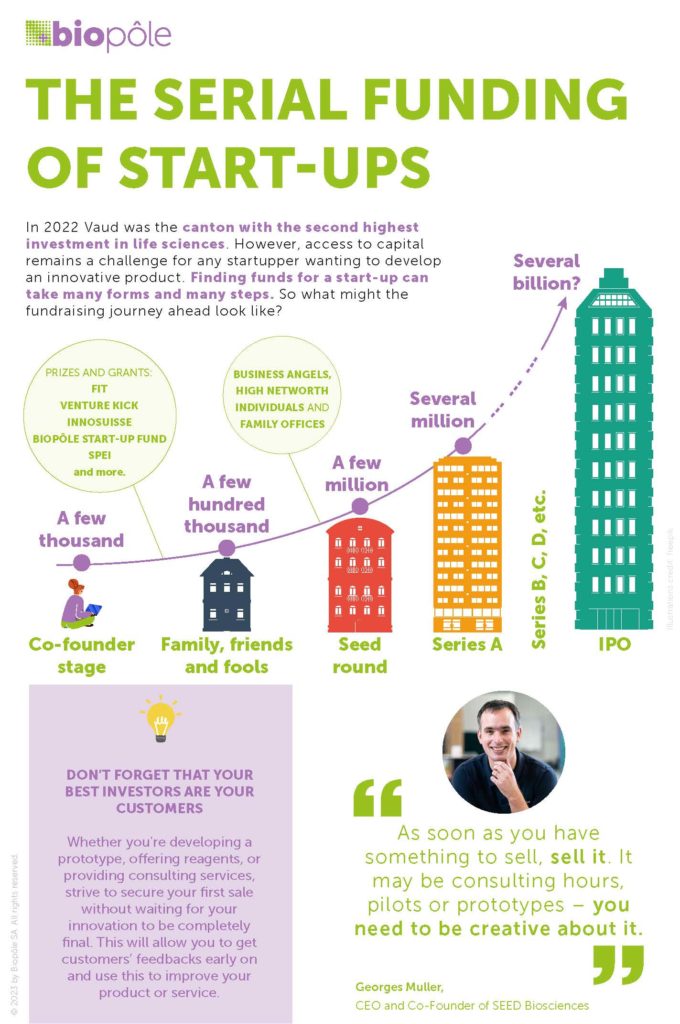

The market potential of Distalmotion and our surgical robot Dexter is tremendous, which makes us very attractive for investors: we’re on an exciting journey commercially and from a financing perspective. But fundraising is still excessively hard. We’re going into a space that requires large amounts of money. Even though we’ve raised several hundred million Swiss francs, if we want to go to the US alone, without a strategic partner, we need to raise a few hundred million more.

It’s a costly domain we’re in, so it was very hard for us to encourage those early investors to take a risk. It was also difficult to demonstrate that we could succeed, not only from a technological, clinical and commercial perspective, but that we could also secure more money later on. It took a lot of trust building – we’re always working on our credibility, not only to convince clients, but also to attract investors.

We were funded by private investors in our first six or seven years. When we moved to venture funding, I spoke to over one hundred venture capitalists across Europe, the US and China over three years before we found our first investor. During that period we were technically bankrupt a couple of times; we were out of money for several months. We sometimes couldn’t pay salaries. This financing phase was very tough, but I understand the investor’s perspective: it’s a big bet to put hundreds of millions on a team of young people that are doing something for the first time.

Doing the groundwork

During its first five years, Distalmotion was doing research to figure out what the optimal value proposition for on-demand robotics was going to be. From the very first day, we weren’t only considering the customers for the product: the physicians, the surgeons, the hospitals. We also tried to understand the customers of the company, the potential acquirers of Distalmotion. Ultimately, the value proposition we designed with Dexter is uniquely optimised for both those targets. This gives us a great opportunity to sell Dexter to our clients, but it also creates a great platform and opportunity for the company to be acquired by a strategic acquirer once we have all the proofs from a regulatory and marketable adoption perspective.

We worked very closely with 40 to 50 surgeons across Europe to explore concepts. From the start, we strove to be in real-life clinical use as soon as possible. Back in 2015 we began an initial clinical pilot with very early-stage concepts. We’ve always leveraged the advantage that a smaller venture has. Since our early days, we’ve been agile and quick at iterating: going out into the field, learning what works and what doesn’t, going back to the lab, improving a product, then going back to the surgeons. So, every six months or so we had a new version of the concept that was ready for testing.

It was through this process that we started to refine not only our understanding of the unmet need we’re fulfilling, but also the technology required to match that unmet need. All this work was the foundation that enabled us to develop the product and start to build it in 2018, get it approved in 2020 and get it into day-to-day clinical and commercial use by 2022.